2024 Q3 In Review: A Bumpy Ride Up

What we saw:

To say this was one of the more eventful quarters U.S. markets have had recently would be an understatement. It started on July 13th with an attempted assassination of the former president of the United States, Donald Trump, and ended with the first Federal Reserve policy rate cut since 2020. There was plenty of political turmoil during the quarter as President Joe Biden ended his reelection bid on July 21st and Vice President Kamala Harris became the presumptive presidential candidate for the Democratic Party. A second assassination attempt against Donald Trump was thwarted on September 15th. At the time of writing this review, it is unclear who will win the election. While the amount of political uncertainty rose throughout the third quarter, we do not believe the market reacted much to this political uncertainty. Instead, we believe the market continued to react to inflation numbers, other economic data, and the Federal Reserve.

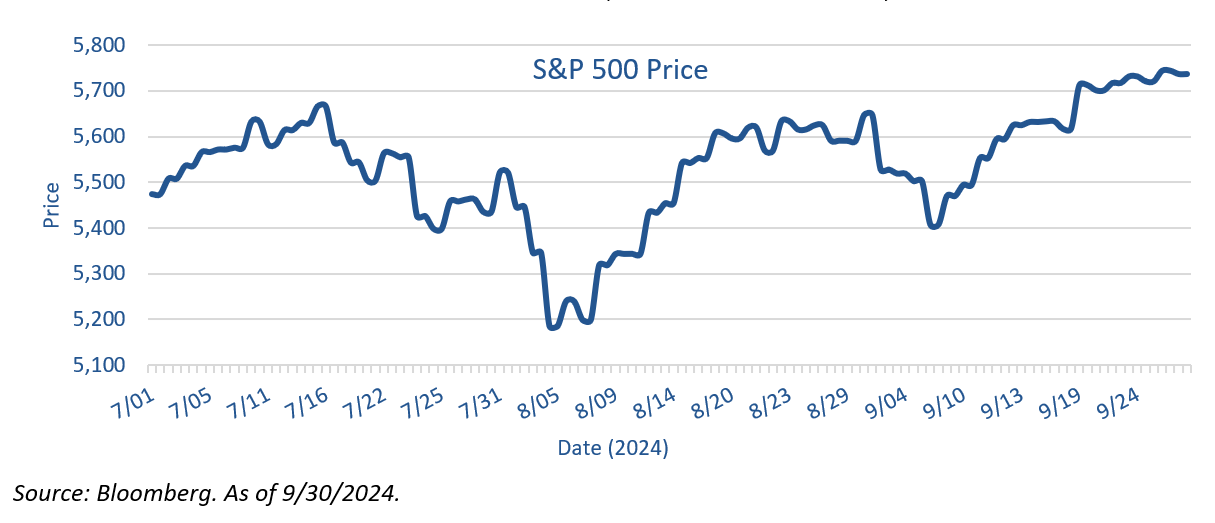

The market initially rallied in July but following the June Consumer Price Index (“CPI”) report release on July 11th, we saw an unusual underperformance by the large cap growth stocks that have been so popular for the last 18 months. The S&P 500 initially peaked shortly thereafter on July 16th. A small decline began and then accelerated after the July 31st Federal Reserve meeting, ultimately bottoming on August 7th. During this decline, the S&P 500 fell 8.3% peak to trough, the NASDAQ 100 dropped 13.6%, and NVIDIA dropped 26.7%[1]. We believe the NASDAQ 100 is a useful proxy for the large cap high tech stocks, like NVIDIA, which have been popular lately and driven a lot of market returns. The index performance in the second half of July suggests that smaller value stocks outperformed the large growth stocks during this period. The Russell 2000 index, which is representative of small capitalization stocks, experienced strong performance for the third quarter (up 9.3%, compared to the S&P 500 +5.9%, and the NASDAQ 100 +2.1%), supporting this sentiment[2].

August 8th was the beginning of the rebound rally. That morning it was reported that US initial jobless claims declined significantly. This positive economic news indicated that the Federal Reserve may not have waited too long to cut which had become a growing fear amongst investors. It also gave traders confidence there would be a policy rate cut during the Fed’s September meeting.

The August CPI numbers were reported on September 11th and came in with the lowest annual increase (2.5% year-over-year) since February 2021. This gave the market further confidence that the Fed would opt for a 50 basis point rate cut, rather than just 25 basis points, at the September Fed meeting. Fast forward a week, the Fed did indeed cut its policy rate by 50 basis points and the market reacted positively, continuing upward through the end of the quarter. We do want to note that one member of the Federal Reserve Board voted against the 50 basis point cut in favor of a 25 basis point cut. This was the first non-unanimous vote for the Federal Reserve Board since 2005.

The S&P 500 was up 5.89% for the quarter marking another strong increase this year.

What we’re watching:

Relative to Q3, we believe Q4 has somewhat limited catalysts. Of course, the election in the U.S. will be important, but we do not believe the impact on the equity markets will be large. In fact, the question we have received more than any other recently is “Which candidate will benefit/hurt the market if elected and what are we going to do?” However, we do not believe this is a pertinent question for long-term investors. Politics are important for other reasons, but at this point in this market, it does not seem like either outcome in the election will move the needle much in the short term. Long-term policy changes do have long-term impacts and we believe that is worth paying attention to, but we do not advocate for allowing your political beliefs to dictate your investment strategy. Long-term, the US stock market has been resilient, and it is generally best to stay invested even when you do not like who is in office.

We do expect the Federal Reserve to continue cutting the policy rate. While this should be a positive catalyst, as we have been saying all year, this optimistic market has likely already priced it in. Further decreases in inflation could be a positive catalyst while further increases in unemployment could be a negative catalyst. Overall, we expect the market to react positively to positive economic news and negatively to negative economic news. While that may seem like an obvious statement, it has not always been the case. In fact, we would argue in the last 10 years, the opposite has more often been true.

Overall, we remain bullish, but we recognize the market has marched higher for eight quarters in a row now and may take a breather. However, the long-term horizon, which in our opinion is the most important horizon, still looks positive .

[1] Source: Bloomberg LP from July 11-August 7, 2024.

[2] Source: Bloomberg LP as of September 30, 2024.

Past performance does not guarantee future results. Investing involves risk, including the loss of principal.

Definitions:

Basis Point: A basis point is a unit of measurement used in finance to describe one-hundredth of a percentage point, or 0.01%.

S&P 500 Index: The S&P 500 is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S., designed to measure the overall performance of large-cap U.S. stocks and often used as a benchmark for the broader U.S. equity market performance.

Nasdaq 100 Index: The Nasdaq 100 is a stock market index that includes the 100 largest non-financial companies listed on the Nasdaq stock exchange, representing diverse sectors like technology, consumer services, and healthcare.

Russell 2000 Index: The Russell 2000 is an index representing the 2,000 smallest publicly traded companies in the Russell 3000 index, providing insights into the performance of small-cap stocks in the U.S. market.

One cannot invest directly into an index.

This blog is created and authored by SRH Advisors, LLC (“SRH”) and is published and provided for informational purposes only. The opinions expressed in the blog are our opinions and should not be regarded as a description of services provided by SRH or considered investment, legal or accounting advice. Certain information sited is from third-party sources and while we believe the information to be accurate and true to the best of our knowledge, we cannot guarantee its accuracy as there may be certain unknown omissions, errors or mistakes. Use of third-party information, including links, is in no way an endorsement by SRH. The views reflected in the blog are subject to change at any time without notice. Nothing on this blog constitutes investment advice, performance data or any recommendation that any security, portfolio of securities, investment product or investment strategy is suitable for any specific person. Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by SRH), or any non-investment related content, made reference to directly or indirectly in this blog post will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Not all SRH clients and investors will have the same experience within their portfolio(s) and certain topics discussed in this blog may not apply to all clients or investors. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this blog serves as the receipt of, or as a substitute for, personalized investment advice. To the extent that a reader has any questions regarding the applicability of any specific issue discussed above to his/her individual situation, he/she is encouraged to consult with the professional advisor of his/her choosing. SRH is neither a law firm nor a certified public accounting firm and no portion of the blog content should be construed as legal or accounting advice. A copy of SRH’s current written disclosure statement discussing our advisory services and fees is available upon request.